BREXIT- What it means for Commodity Market

Introduction

Today most of the dialogs about the United Kingdom are spinning around Brexit and its impact on different sectors. Commodity Sector, by virtue of its importance in a country’s trade and commoners’ lives, necessitates a study as UK plays a crucial role as being a large exporter and also a significant importer of many commodities. Moreover, commodity financial market in London is one of the most reputed ones in the world. UK plays a key role in physical commodity market (a market that trades in primary economic sector rather than manufactured products) as well as the financial derivatives market pertaining to base metals (like copper, zinc, aluminium etc.).

Let’s understand the contribution of commodity market towards UK’s GDP, how things might change after the Brexit and whether London manages to retain its position as a global financial hub post-Brexit.

Commodities & UK: A close bonding

UK’s trade figures: What recent numbers say?

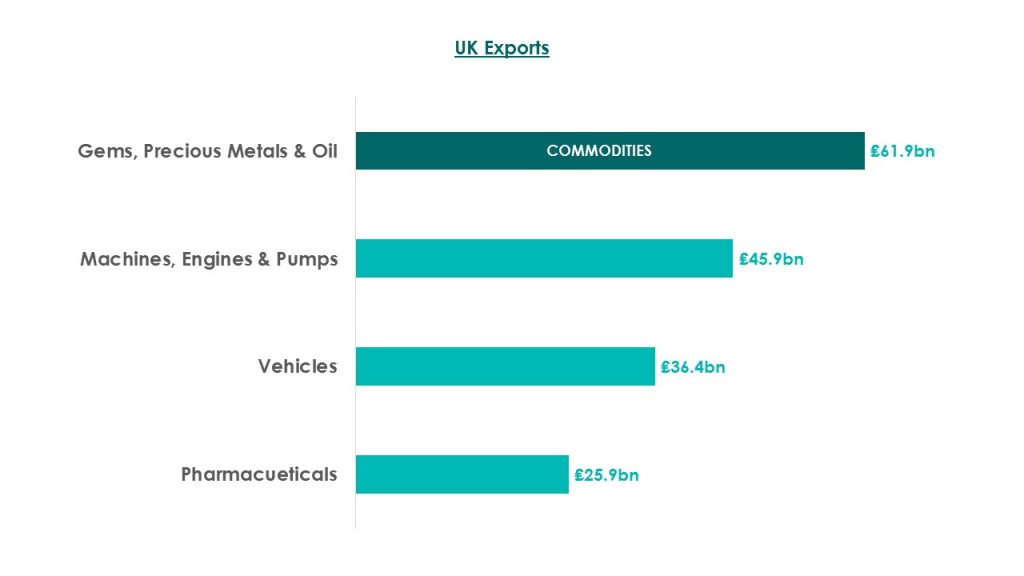

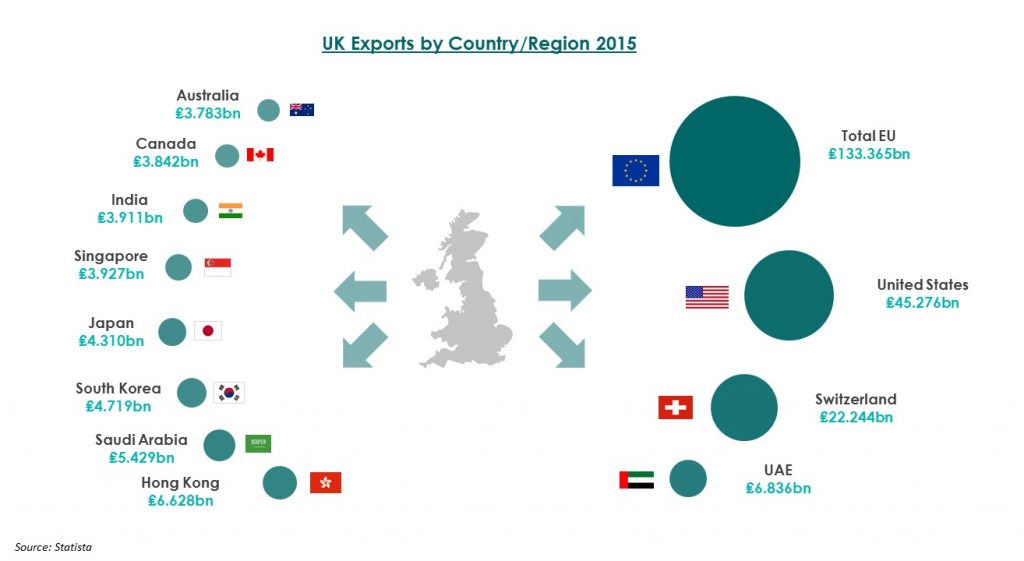

The United Kingdom, being the world’s 9th largest export economy shipped goods worth $460.1 billion in the year 2015. Primary commodities like gems, precious metals, oil etc. contributed around 20 percent of the total exports in 2015 and the export of precious metals from the UK has surged remarkably in the last three years.

Fuelling UK’s economy

The two types of commodity markets- physical and financial markets together strengthen the UK’s economy. A physical or primary commodity market is the one where purchasers actually buy the commodities while a financial market is the one where the participants buy or sell the right to purchase or deliver commodities at a future date, also called commodity derivatives market.

Contribution of primary commodity market:

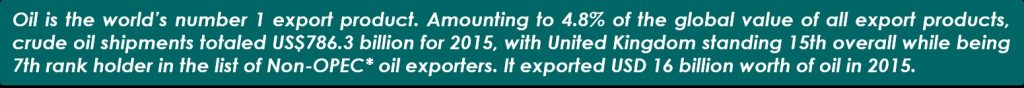

In primary commodity market, the UK exports crude oil, refined oil, iron, steel, jewelry, cereals and many other commodities which eventually contributes towards boosting its GDP. For UK, year 2015 happened to be a good one in terms of crop production. Apt weather for the second year running led to record high cereal yields, thus pushing prices lower.

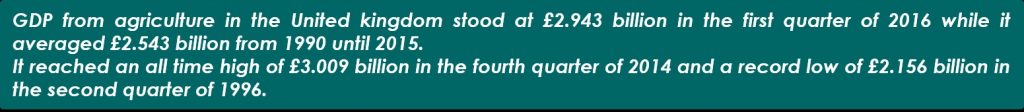

Total earnings from farming industry is the income to those with an entrepreneurial interest in the agrarian industry, typically farmers and partners. Income from agriculture in the UK dragged lower by around 29% between 2014 and 2015 in real terms, to £3.77 billion. The 2015 value was driven by subdued commodity prices and lower direct payments because of a less favorable euro/sterling exchange rate.

North Sea oil and gas production plays a major role in boosting the British economy. This industry offers employment to around 450,000 people across the UK. According to a recent data, output from mining industry, which also is an important part of primary sector, stood at £7.58 billion in the first quarter of 2016 and has averaged £12.77 billion from 1990 until 2016.

Contribution of financial market

A commodity market is a financial market that makes trading possible in raw products rather than manufactured ones. Commodities can be categorized as hard and soft. Hard commodities are the ones that are mined or extracted (gold, rubber, oil, etc.), while soft commodities are essentially the farmed crops or livestock (corn, wheat, coffee, sugar, soybeans, pork, etc.). To participate in commodity market, one can buy equity shares in companies whose business depends upon commodity prices, purchase mutual funds, Exchange Traded Funds or by entering into a futures contract or any other similar derivative products.

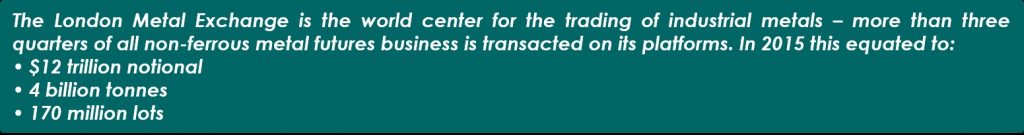

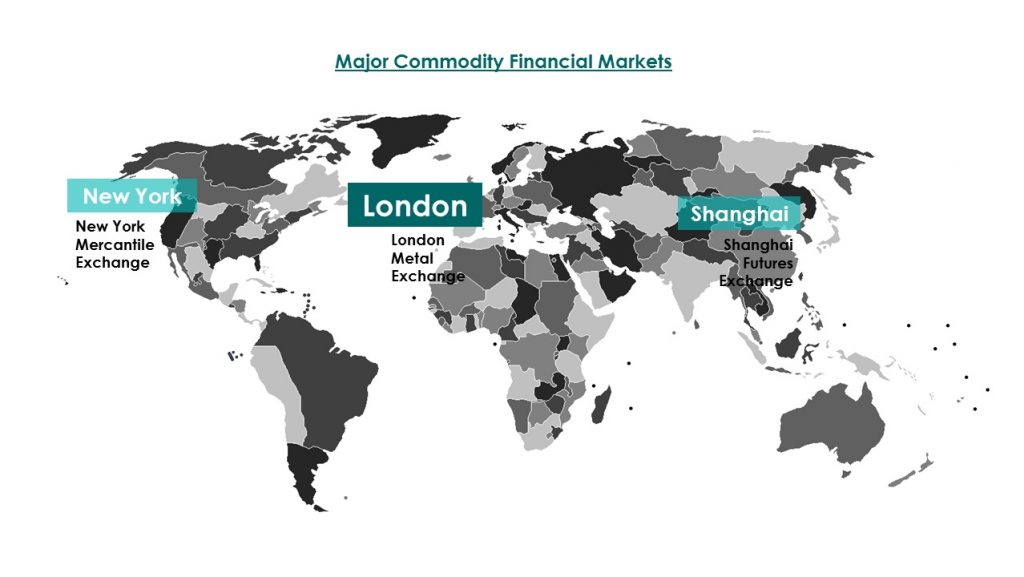

The financial services industry plays an important role in UK’s services sector which contributes around 78% towards its GDP. London is a major center for international business & commerce and is one of the three financial hubs of the global economy (alongside New York City and Tokyo). The City houses the London Stock Exchange, the London International Financial Futures and Options Exchange, the London Metal Exchange, Lloyds of London, and the Bank of England.

The London Metal Exchange, which provides a platform for trading various commodities is the world’s premier non-ferrous metals market with highly liquid contracts. It is not commonly known to the public in large, but is widely appreciated and respected by the mining, metals and financial communities globally. It provides indispensable services that play a crucial role in providing a stability to commodity prices across the globe. The LME is one of the leading international commodity, futures and options exchanges and offers specialized services in nonferrous metals-Copper, Primary Aluminium, Lead, Zinc, Nickel, Tin, Aluminium Alloy, Silver and also an interesting index contract named LMEX, which tracks the six primary metals traded. The platform of LME provides value chain participant-producers and consumers of metal with a physical market of last resort and products to hedge against the risk of volatile metals’ prices. It has a massive turnover, both in terms of value and volumes, and contributes considerably to the UK’s invisible earnings each year.

Commodities-Impacting all industries

Dependence on commodity market is inevitable and to a large extent irrespective of the industry one directly belongs to. Almost all businesses are dependent on commodities, directly or indirectly. Inflation, in general, affects everyone and when we talk about rising inflation, we are essentially talking about increasing prices of commodities such as oil, grains etc.

There are a lot of industries directly impacted by change in commodity prices while the effect on some industries may be secondary.

- Many industries’ profitability like the ones associated with textile, automobile, FMCG etc. depend directly on commodity prices as they are the consumers of some or the other commodity. For example: textile industry is dependent on cotton, automobile on iron and steel while FMCG depends upon wheat, rice, sugar etc.

- However, impact on some industries may not seem obvious. For example, for a telecom company, prima-facie it appears that its business is unrelated with the commodity market but a closer look reveals that the profitability of a company in telecom sector is dependent on the prices of metals such as iron, copper etc., as it would require the same for hardware that need to be installed, for effective signal transmission. Further, the business is dependent on the sale of mobile phones in a country. The increased sale of cellphones would result in more people choosing company’s network (law of probability, assuming the services are competitive!), costing of which in turn is dependent on prices of various metals like silver, copper, lead (in batteries) used in mobile handsets.

- Even for a financial services company involved in lending business, many of its clients’ profits may be dependent on different commodities, increase in prices of which may affect the amount of lending/borrowing activities in the industry, hence affecting the business.

BREXIT: Impact on UK’s commodity market

The people of Britain voted for a British exit from the EU in a historic referendum. The outcome has prompted euphoric celebrations among Eurosceptics around Europe but sent tremors through the global economy.

Impact on commodities

The uncertainty still looms around UK’s future outside the European Union (EU), making people think that ‘Brexit’ is a leap into the unknown. The impact of Brexit on commodity market as a whole will depend on the model which UK follows. According to a study conducted by London School of Economics [i], one of the below mentioned options may be followed by the UK and there are economic benefits for UK from European integration, but obtaining these benefits will come at the political cost of giving up some sovereignty.

- “One option is ‘doing a Norway’ and joining the European Economic Area. This would minimize the trade costs of Brexit, but it would mean paying about 83% as much into the EU budget as the UK currently does. It would also require keeping current EU regulations (without having a seat at the table when the rules are decided).

- Another option is ‘doing a Switzerland’ and negotiating bilateral deals with the EU. Switzerland still faces regulation without representation and pays about 40% as much as the UK to be part of the single market in goods. But the Swiss have no agreement with the EU on free trade in services, an area where the UK is a major exporter.

- A further option is going it alone as a member of the World Trade Organization. This would give the UK more sovereignty at the price of less trade and a bigger fall in income, even if the UK were to abolish tariffs completely.

- Brexit would allow the UK to negotiate its own trade deals with non-EU countries. But as a small country, the UK would have less bargaining power than the EU. Canada’s trade deals with the United States show that losing this bargaining power could be costly for the UK.”

UK farmers currently enjoy free access to the single market of 500 million customers and that Europe accounts for 73% of Britain’s agri-food exports, worth about £11bn a year. As part of the EU, the UK benefits from the ‘single market’ with free movement of goods around the EU. Had Brexit not happened, the EU planned to invest almost £22bn in common agricultural policy (CAP)** funding in the UK between 2014 and 2020.

Any restrictions on the free movement of labor and other legislation related to food industry as a result of Brexit may have a huge impact on the UK’s agri-food industry.

Conclusion

The market pertaining to commodities is huge in the UK and plays a considerable role in the development of the country. However post-Brexit, primary commodity market and the financial market in the London is uncertain about their future growth prospects. An index that measures the magnitude of discussion of economic policy ambiguity in American newspapers (Economic Policy Uncertainty index[ii]) has climbed steeply in recent days. The level is comparable to the peak levels reached over recent decades, a period that encompassed the turbulence of Sept. 11, the uncertainty of the Iraq war, the breakdown of Lehman Brothers and the ensuing financial crisis.

Many see Brexit as a test of time for UK and the country is standing at a crucial juncture where its key decisions will shape its long term growth. With great challenges come great opportunities and the commodity market, be it primary or financial, beholds plethora of opportunities and it will be interesting to see how future unfolds for the UK commodity sector.

Excitingly, commodities are closely knitted with individuals as well as corporations and is an integral component of our lives. Anything that impacts commodities will affect most of us. Of course it will be interesting to see the future of commodity market in the UK and also will London be able to save its position as a global financial center, but more important is keeping a close eye on this sector, which happens to be the lifeline of any economy.

*Non-OPEC: Oil production from countries outside the Organization of the Petroleum Exporting Countries (OPEC).

**The Common Agricultural Policy (CAP) is the agricultural policy of the European Union. It implements a system of agricultural subsidies and other programmes.

[i] http://cep.lse.ac.uk/pubs/download/brexit01.pdf