I. INTRODUCTION

Unbundling has definitely caught up with the insurance sector and incumbents are finally taking note of the shifts in this landscape. These forces are being aided in their disruption of across the insurance value-chain by a multitude of forces, including the exposition of digital technologies, the generational changes that are brought to bear with the coming of age of millennials, the changing dimension of scale itself, and new business models. As millennials introduce incumbents to new forms and means of interaction, scale can be captured by means of digital platforms like never before and new products exploit the reluctance of incumbents. Today, accelerators are launching left, right, and center, there is the promise of new solutions, and also the threat from disruptive models; but what has become apparent in this environment, is that every major insurer is keen to do have a decided opinion on these changes and to do something about it!

These disruptive forces are straining the largely traditional insurance sector at various fault lines: issues that have, by convention been considered the prerogative and as inseparable from what insurance is, such as how and when to assess risk, what can be insured, how insurance products can be delivered, etc. Although some of these movements could prove to be of great significance, there has, for long, been a distinct lack visibility into the activity of startups and a want of participation from incumbents. The actuation of these forces has largely remained behind the curtain, so to speak, with little attention being paid to the extent of innovation or the solutions being devised by startups. However, the reality is that some of the ideas to have found execution could alter insurance as we have known it.

“We’re excited about insurance. If you think FinTECH is big, just wait.”

— Yann Ranchere (Anthemis Group)

Taking cue and context from the disruption of banking can be hugely beneficial for understanding the insurance ecosystem. If anything, that whole universe of fintech startups unbundling banking show the tremendous potential of these disruptive forces when they make landfall, the tremendous value that can be captured, and the expeditious manner in which they can accelerate the modernization of incumbents. It highlights the huge window of opportunity that is opening up in the insurance sector, as it moves through this transformative phase. Some observers have even noted that, for banks, the finTECH ecosystem has been an excellent mechanism for outsourcing their research and development efforts. Indeed, banking incumbents have had a timely opportunity to get on the bandwagon of disruptive solutions, by way of this startup province. This ecosystem has allowed them to fast-track experimentation, create quick prototypes in response to market demand, and directly pick solutions that work. It has substantially catalyzed the reform of banking, steering traditional institutions along a course of digital modernization. Following in the footsteps of their cousins, insurers too are now making strides to tap into this ecosystem by creating ad hoc internal frameworks and launching accelerators.

“What I’m really excited about is insurance. There is a huge opportunity in insurance and I can count on my fingers the number of insurance tech startups I’ve seen in the past 18 months out of probably hundreds of fintech startups.”

— Rob Moffat (Balderton Capital)

II. InsurTECH: STATE OF DISRUPTIONS

We’ve been tracking disruption of the insurance space for some time and according to our research there are several trends that have emerged during the past quarters. Reviewing these currents would provide a big-picture understanding of the changes in this sector. These are summarized in the following:-

- Group Insurance Taking Over Individual Insurance

Perhaps the most obvious, but also the most far-reaching and profound, group insurance might just be a game-changer. This is gradually transforming into a gravitational drift in the market, with some of the more confirmed and prevailing insurTECH startups active in this segment. This has also been the segment that received the most attention when BoughtByMany snatched the inaugural ‘FinTECH Innovator of Year’ award, away from Zopa, Lloyds, and Misys. The group insurance ecosystem is also rife with evolutionary activity, as startups make incremental changes. The peer-to-peer insurance model of Friendsurance, Guevara, and PeerCover has been tweaked to admit special circumstances and allow customization. This has been amply demonstrated by BoughtByMany. Another adaptation of this model has been accomplished by Gaggel, which offers add-on rewards and returns for banding together in groups. Another interesting aspect in this segment is that while the B2C section moves to a discount-through-clustering (P2P) model, we’re seeing something of the opposite in the B2B segment,

which is observing a shift towards greater customization and away from grouping.

- Personalized & Dynamic Risk Profiling

Another searing current that has made inroads into the insurance ecosystem is the changing nature of risk profiling. The ubiquity of sensors through the proliferation of wearables and other IoT devices, coupled with advanced big-data analytics, has enabled dynamic modeling of insured risk. This is gradually gaining momentum and upending legacy risk profiling, as risk can now be assessed on a continual basis. What is more, risk profiling can now be customized, instead of herding customers into generic buckets. This personalization is becoming cheaper still, with the mushrooming of sensory devices capable of feeding data into insurance algorithms and a generous impetus provided by regulatory frameworks, such as the recent EU directive for installing a telematics device (eCall) in all new cars. Whereas, previously the customer’s risk-profile could only be updated after a periodic reconsideration of risk, while policies were being renewed, they can now be reassessed and revised on an ongoing basis. This is most clearly visible in the telematics-fuelled motor insurance space, where the pay-as-you-drive model of MetroMile, the safe-driving discount model of DriveLikeaGirl, the niche solutioning of Marmalade Insurance, the incentive structure of InsureTheBox, and the rewards model of MileBox are providing for interesting alternatives. Similar solutions are being devised in other insurance segments, such as healthcare where BeamDental and Jastr are providing devices with inbuilt sensors, allowing activity monitoring and improving risk assessment. In summary then, as the WEF’s Future of Financial Services report, from earlier this year, highlights, “Connected devices now provide the platform for a new bidirectional relationship with rich potential to benefit both insurers and customers by replacing a passive model with a highly interactive one. Insurers will evolve to deliver value by acting as a real-time risk concierge or trusted adviser.”

- Social Insurance

Another trend that is only beginning to make its presence felt in the market, is the association of social attributes with core insurance solutions. Some have even hailed this as the forthcoming era of insurance 3.0, with insurance 1.0 being traditional insurance and insurance 2.0 being digital insurance by way of comparison websites. In making insurance social, startups are connecting customers to each other, thereby creating communities and giving customers talking points. The shift from a wholesale to a retail model of insurance is at the heart of this transformation. Albeit self-evident, group insurance is perhaps the best example of this, with companies such as BoughtByMany, Friendsurance, and Gaggel banding people together over insurance. Even the rewards offered by MileBox and the chirpy girl-themed branding of its motor insurance products by DriveLikeaGirl are creating conversations around insurance.

- Product-Service Combinations

Our research has indicated that almost half of the insurTECH startups are disrupting aspects of the insurance product. What started with telematics in motor insurance, as a way to customize through dynamic risk profiling, has rubbed off on other segments where devices are being combined with insurance products to create more holistic and meaningful experiences that benefit the customer in more than one way. In the healthcare segment, this has been accomplished by BeamDental and Jastr, who also provide devices along with insurance products.

- Experience-Driven Business

Increasingly, we are seeing a move towards an experience driven packaging of insurance products. While there may be observed several streams under this umbrella, at a conceptual level, all customer-facing insurTECH startups are creating more engaging (at times, even delightful) experiences around insurance products. While some, like Knip, are creating an experience around managing insurance, others such as MileBox are offering rewards. There are also those, such as Oscar, CollectiveHealth, and B.Well, who are transforming the entire life-cycle of owning an insurance product into an engaging experience.

- Digital-first insurance disrupters

This would seem unsurprising, but we’re also seeing the rise of digitally native insurance providers. These aren’t necessarily disrupting the core insurance product but are certainly opening up new delivery channels, exploring new markets, and catering to segments of underserved customers. Zhong An (China) and Oscar (USA) are perhaps the best examples for this. There are other direct sales companies that are taking advantage of the digital realm for sales and distribution channels, such as Verti, a spin-off by MAPFRE. Then, there are even others that are not only using the digital-first infrastructure for distribution, but are also innovating other aspects of the product. Bima, for instance, has carved out an entirely non-existent market among the financially marginalized populace in emerging markets, by providing mobile-delivered insurance and micro-insurance services.

- Niche Products

The reluctance of traditional providers is being exploited by new entrants, who are creating novel solutions and exploring untapped opportunities. Niche products are testing the limits of what insurance is and what all it can do for the end customer. While some are new solutions geared towards solving existing problems in the insurance ecosystem, others are crafting entirely new solutions. RecordSure, Quan Template, and AnalyzeRE are, we feel, excellent examples of what new technologies, entrepreneurial energies, and the right execution can to improve the business of existing players. The hyper-local insurance for the residents of Vienna provided by SeasWein is an interesting case of the contextualization of insurance products. Then, there’s Meteo Protect which provides risk coverage from adverse weather and Bima which has done for insurance what Grameen Bank and other MFI’s have done for providing banking services to the financially marginalized.

III. RESPONSE OF TRADITIONAL PLAYERS

The insurance segment has witnessed a scattered response from incumbents, with several having launched labs and other such internal divisions to source incremental innovations from within the organization. The activity has only intensified over the past year and, as the realization of disruptive shifts in the market seeps into the traditional ecosystem, deeper engagement can be expected. Collectively, the insurTECH space has seen funding of over $2bn since 2010, most of which has only poured in since the start of last year.

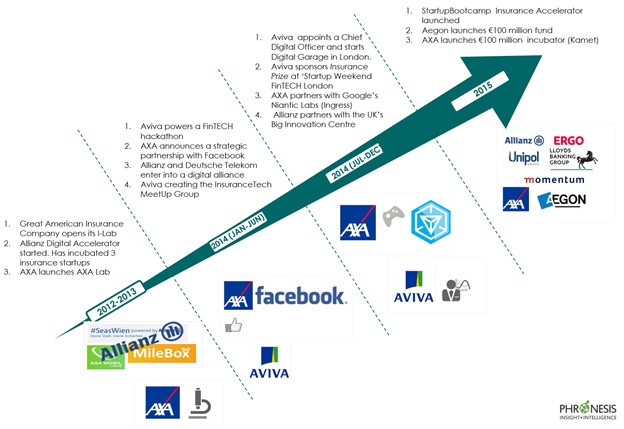

Among the most active incumbents in the Western hemisphere have been Aviva, AXA, and Allianz. Aviva has been particularly responsive to these market forces and has made rapid strides to ingratiate itself into the disruptive ecosystem by, for instance, powering hackathons, creating local Meetup groups, and setting up a Digital Garage at the Silicon Roundabout, in London. Aviva also appointed a Chief Digital Officer in the fall of last year. AXA too has made rapid strides towards internalizing some of these disruptive tendencies. It not only formalized a strategic partnership with Facebook, but also inked a partnership with Google’s Niantic Labs to integrate 20K of its global retail agencies into an augmented reality massively multiplayer online game. However, what may come as a surprise to many is that Allianz had established an accelerator in 2013, which has already incubated three insurTECH startups. Also, mid last year Allianz entered into a digital partnership with Deutsche Telekom. More recently though, earlier this year several insurers including Allianz, Intesa Sanpaolo, MunichRE, Tyrg, ERGO, Admiral, Lloyds, and Momentum, have partnered with StartupBootcamp for the launch of an insurTECH accelerator program. Earlier this summer, the Dutch insurer Aegon launched a VC fund with a budget of €100mn for investing in finTECH startups, while the Italian insurer Generali revealed plans to invest €1.25bn in finTECH startups, by 2019. Even more recently, AXA revealed its plans to leverage the Bitcoin ecosystem in disrupting the $582bn remittance market, by collaborating with startups active in the space, and launched a €100mn incubator (Kamet).

In summary then, activity is heating up exponentially in this space and it is only now that the window of opportunity is being exploited by incumbents.

IV. THE POSSIBILITIES ARE ENDLESS

Disruptions in the insurance sector are not only inevitable but reflect the changing face of market forces and should be viewed as a healthy opportunity for the incumbents to maintain their relevance in the current market environment. It can prove to be a wonderful opportunity for fast-tracking the transition of traditional players to the digital social era and, judging by the size of this industry, the possibilities are endless. If what has happened in the larger finTECH sector can serve as a guide, we see that a lot of changes will transpire in moving insurance to the next level and that the opportunities would be immense. The actuation of these forces will culminate in the realignment of the insurance sector around simpler, more meaningful solutions and better experiences. As the dynamics of this industry are recast, tectonic shifts may be expected and the sustenance of existing businesses can only be ensured by embracing the relevant attributes from among the barrage of changes.

At such a crucial moment of flux, there is a clear imperative for the established market actors to chart a strategic roadmap that takes stock of possible future scenarios and aims to align the organization’s response with the role it sees itself fulfilling. Some such future scenarios may be teased out of the trends that we have highlighted just above. The infusion of a social element in insurance and the transformation of solutions into experiences will be major influences in shaping future products a delivery. Moreover, as the market swells up with new ideas and novel solutions, the sourcing of these innovations, their adaptation, and execution would be paramount for incumbents. Execution and assimilation are the key for incumbents to expedite this transition. We might even see the emergence of platform providers who can re-bundle various insurTECH solutions into seamless experiences. Alternatively, there could be witnessed a further unbundling of the distribution channels for insurance (which may be superseded by more entrenched universal platforms), as it turns from a complex financial service into a commodity. To conclude then, whatever these future scenarios might hold a considered opinion and well-reasoned response can only be devised through an understanding of these disruptive forces and the positioning of other players relative to the one’s own. In this, research can be hugely beneficial to tease out the right opportunities that may be capitalized upon in the nick of time.