Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

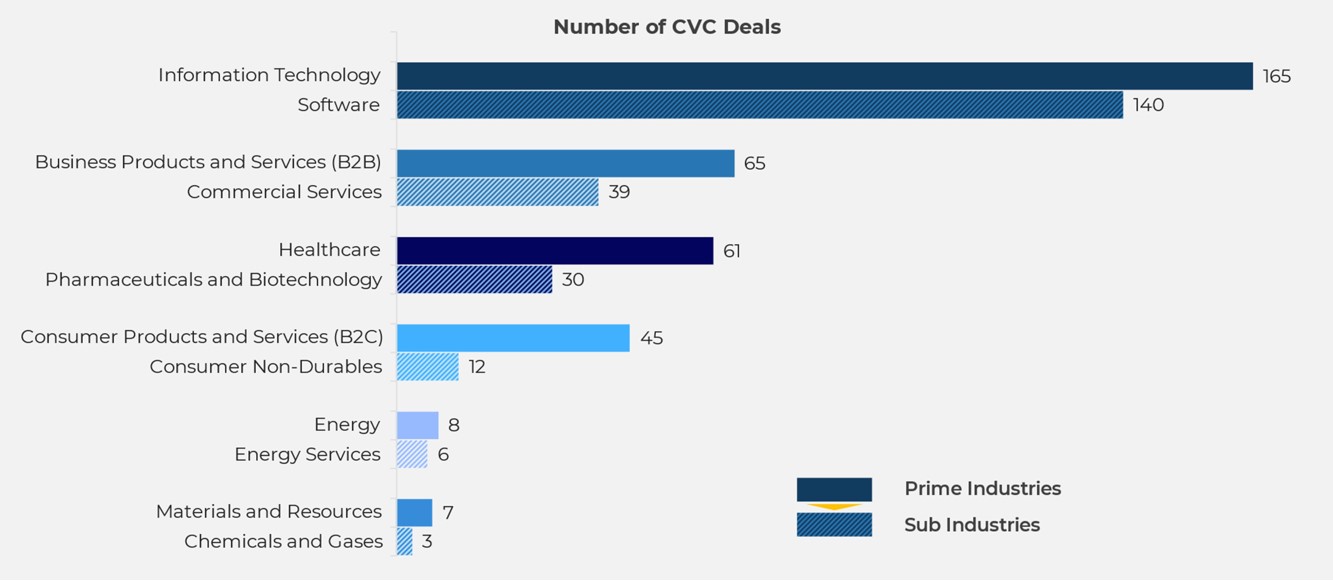

The number of deals that took place by industry is illustrated below.

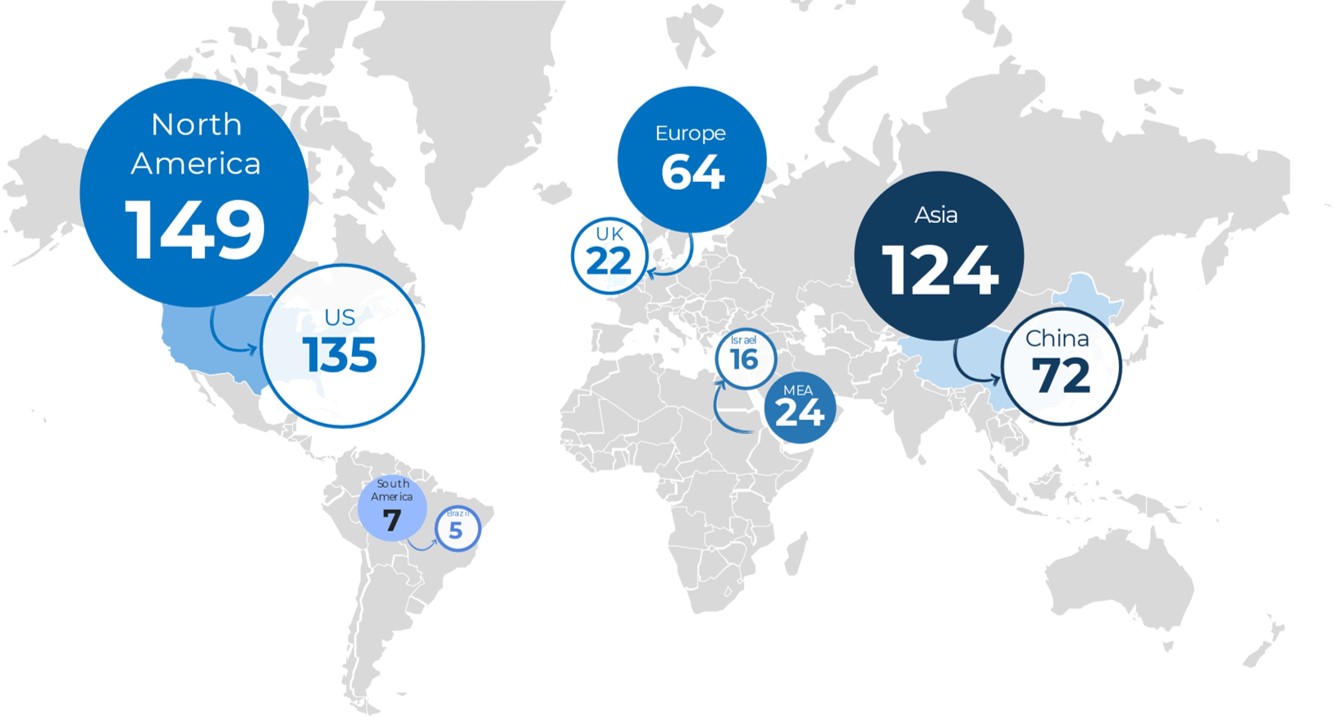

A breakdown of the number of deals by region shows that the highest number took place in North America (149) followed by Asia (124) and Europe (64). The US and China account for the most deals per country with 135 and 72 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

13 JULY 2021

SES Holdings enters a definitive agreement for a business combination with Ivanhoe Capital Acquisition Corp. (CVC included: GM Venture, LG Technology Ventures)

- The business combination will create the first publicly-traded, hybrid Lithium-Metal battery supplier combining high- energy density with efficient manufacturability at scale. The combined company will trade under the symbol ‘SES’ after deal closure

- This transaction will provide SES up to $476 million in gross proceeds to fund expansion plans, including $200 million from fully-committed common stock PIPE at $10 per share

- Investors in the PIPE transaction include Koch Strategic Platforms, Hyundai Motor Company, Geely Holding Group, Kia Corporation, General Motors, LG Technology Ventures, Vertex Ventures, Foxconn, SAIC Motor, Fidelity Investments Canada ULC (certain funds), and Franklin Templeton

- The pro forma implied equity value of the combined company is approximately $3.6 billion, inclusive of a $300 million earn-out. Deal completion is expected in Q3 2021 or Q4 2021

07 JULY 2021

AnyVision secures $235 million in Series C funding (CVC involved: Qualcomm Ventures)

- AnyVision, an Israel-based visual AI platform company that helps Fortune 500 brands create safer spaces for employees and customers, has obtained $235 million in a Series C funding

- The financing round was co-led by SoftBank’s Vision Fund 2 and Eldridge. The company’s existing investor list includes Robert Bosch GmbH, Qualcomm Ventures and Lightspeed

- AnyVision will use the funding to continue developing its SDKs, specifically to work in edge computing devices, smart cameras, body cameras, and chips that will be used in other devices, to increase the performance and speed of its systems

- AnyVison systems are used in video surveillance, watchlist alerts and scenarios where an organisation is looking to monitor and control a crowd. For example, to keep track of numbers, to analyse dwell times in retail environments or to flag illegal or dangerous behavior

30 JUNE 2021

Turntide Technologies completes $225 million financing (CVC included: JLL Spark Ventures, Breakthrough Energy Ventures)

- Turntide Technologies, powered with Smart Motor System patented technology, which advances sustainability goals, saves money, and improves sustainability throughout the enterprise, has completed $225 million in convertible note financing

- Investors that participated in the financing include Canada Pension Plan Investment Board (CPP Investments), Monashee Investment Management LLC, and JLL Spark. Other investors include Breakthrough Energy Ventures, Captain Planet LP, and Suvretta Capital Management LLC

- This investment brings Turntide’s total funding to $400 million

- The completion of this funding will support the development of a new cloud-based technology that is due to be released this year for implementation throughout built environments and electric vehicles. The financing also supports the growth and development of its transport line of business for commercial and industrial electric vehicles, launched earlier this month

25 JUNE 2021

Quanta Dialysis Technologies bags $245 million for portable haemodialysis system in Series D financing (CVC included: Novo Holdings)

- Quanta Dialysis Technologies, a British medical technology company developing innovative dialysis products and services, obtained $245 million in an oversubscribed and upsized Series D financing round

- The financing round was led by Glenview Capital and co-led by Novo Holdings. It was also backed by a broad group of other top-tier investors, including BlackRock, Eldridge, Sands Capital, Millennium Management, Monashee Investment Management LLC., Puhua Capital, Segulah Medical and Ancora, alongside Orlando Health, an integrated delivery network

- The funding will allow Quanta to scale up global operations with a focus on the US, where the dialysis system SC+ received the 510(k) clearance from FDA in December for use in acute and chronic care facilities. The company is investing in significant infrastructure to scale up manufacturing, sales and customer service functions to support the system’s use in currently approved care settings within the US, alongside preparing to launch a study to support its future FDA clearance for in-home use within the country

23 JUNE 2021

Lendbuzz secures $60 million in Series C funding round and $300 million in debt financing (CVC involved: MUFG Innovation Partners Ventures, Goldman Sachs & Co. Ventures)

- Lendbuzz, Inc., a Boston-based auto finance platform that primarily serves consumers with weak credit history, obtained

$360 million in an investment round - As part of the transaction, $60 million was received as a Series C funding co-led by Wellington Management, joined by Goldman Sachs & Co. and MUFG Innovation Partners, and $300 million through debt financing led by Goldman Sachs Bank USA

- The equity funding round was also joined by existing investors, including 83North, Eyal Ofer’s O.G. Tech, Arkin Communications, Mivtach Shamir and Highsage Ventures. Viola Credit joined the debt financing

- With the new funding round, the total investments in the company to date have reached $105 million in equity and $650 million in debt

- Lendbuzz’s platform is powered by AI-based, machine learning and proprietary algorithms. The company plans to leverage the raised funds for the expansion of its car dealerships network in the US. In H1 2021, it tripled its loan origination volume

22 JUNE 2021

Insilico Medicine bags $255 million in Series C financing (CVC involved: Baidu Ventures)

- Insilico Medicine develops artificial intelligence systems that utilise deep generative models, reinforcement learning (RL), transformers and other modern machine learning techniques for the generation of new molecular structures with specific properties

- A $255 million Series C financing was led by Warburg Pincus. It was also backed by current investors, including Qiming Venture Partners, Pavilion Capital, Eight Roads Ventures, Lilly Asia Ventures, Sinovation Ventures, BOLD Capital Partners, Formic Ventures, Baidu Ventures, and new investors, including CPE, OrbiMed, Mirae Asset Capital, B Capital Group,

Deerfield Management, Maison Capital, Lake Bleu Capital, President International Development Corporation, Sequoia Capital China and Sage Partners - Insilico will be suing the financing to progress Insilico Medicine’s current therapeutic programs into human clinical trials, initiate multiple new programs for novel and difficult targets, and further develop its AI and drug discovery capabilities

17 JUNE 2021

Neo4j bags $325 million Series F investment, raises its valuation to over $2 billion (CVC involved: GV Ventures, DTCP and Lightrock)

- Neo4j, a graph database vendor founded in 2007, secured $325 million in series F funding round led by Eurazeo, raising the

company’s valuation to more than $2 billion - Other new investors that participated in the round include GV (formerly Google Ventures), DTCP and Lightrock. Existing

investors One Peak, Creandum and Greenbridge Partners also participated - The transaction is considered to be the largest investment in a private database company

- Neo4j will invest the new funds across three primary dimensions – building a multi-cloud service, enhancement of graph data science, and expanding its geographical reach, technologies database and expert service providers

- The company holds a portfolio of more than 800 enterprise customers, including Adobe, AstraZeneca, eBay, Levi Strauss & Co., UBS, Volvo Cars, and Walmart

17 JUNE 2021

Beamery raises $138 million in Series C funding (CVC involved: Accenture Ventures, Workday Ventures, M12)

- Beamery is a London-based start-up that uses artificial intelligence (AI) technology to help the world’s largest companies attract, engage and retain talent at a global scale

- The Series C funding was led by the Ontario Teachers’ Pension Plan Board (Ontario Teachers’), through its Teachers’ Innovation Platform (TIP) and backed by Accenture Ventures, alongside existing investors EQT Ventures, Index Ventures, M12 and Workday Ventures

- The round follows a record year for the company, which finished with 337% annual revenue growth in Q4 and surpassed the one million roles filled on its platform during 2020

- This funding will fuel extensive product development, accelerate commercial growth in existing and new geographies, double Beamery’s rapidly growing employee base, and solidify its leadership position in the talent space

For a PDF copy please download: Corporate Venture Capital News – July 2021.