These are surreal times we are living in. Given the uncertainty that has engulfed world economies, government policies, and the potential recovery from the pandemic, these are challenging times for the investor community as well. Within the last few months, the world has witnessed a large number of established business models crumble while at the same time, new business models have emerged and leveraged the changed reality.

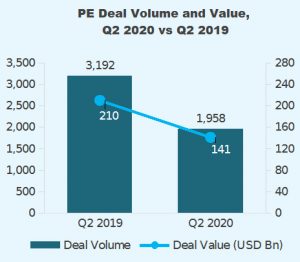

The pandemic has also forced PE firms to follow the line of caution, as most of them have adopted conservative behavior in their investment choices over the last few months. A look at Q2 2020 completed PE deals’ volume reflects ~40% drop as compared with the deal volume in the same quarter last year. The drop in the disclosed deal value also pegged at ~33%. The number of investors who participated in deals also reduced by ~43% from 2,876 in Q2 2019 to 1,649 in Q2 2020.

Deal activity is sector specific

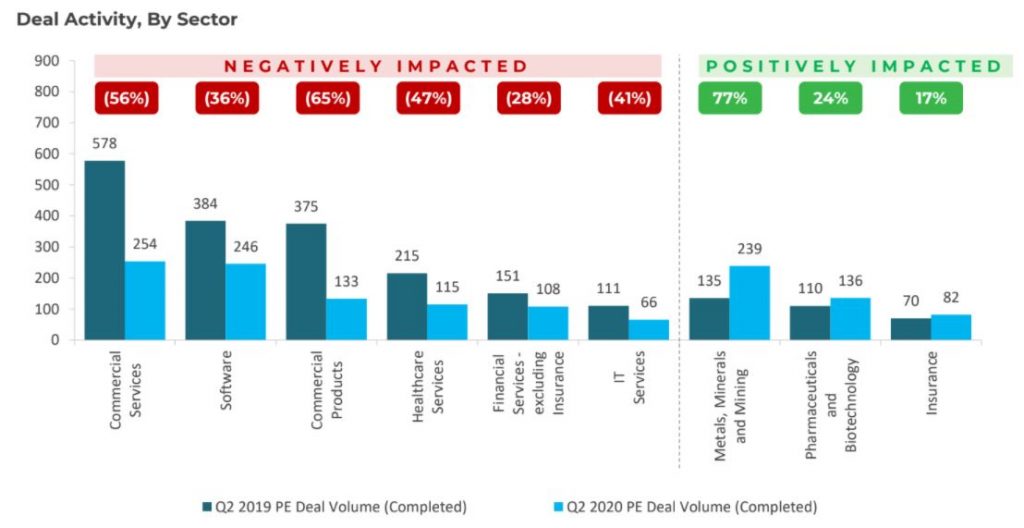

A further assessment of PE deals at the sectorial level reflects a changed reality in lower deal activity across sectors. However, pharmaceuticals and biotechnology; insurance; and metals, minerals and mining sectors have been positively impacted. If we look closely COVID-19 has resulted in enhanced investor interest in the pharmaceutical and health insurance sector, whereas, the mining sector deals are mainly driven by multiple investments in small gold producers amidst increasing prices for the metal and relatively unscathed situation for most of the mines, despite the pandemic.

Some of the other key sectors such as restaurants, hotels and leisure; and retail, have witnessed a significant drop in the deal activity amidst the pandemic.

Deal Activity, By Sector

Impact has been global in nature, with all regions showing reduced deal activity

A regional analysis of PE deals reflects a drop in deal activity across the globe. Asia, Africa and Latin America have witnessed the worst drop, with the pandemic clouding their growth story and future prospects. North America and Europe also witnessed a significant drop in deal activity, reconfirming the widespread impact of the pandemic. On an overall basis, North America maintained its dominant share in the PE deal activity at ~59%, followed by Europe at ~33%. None of the other regions had a significant share, with Asia in a distant third position with a 3% share.

Deal Activity, By Region

Top investors are more selective

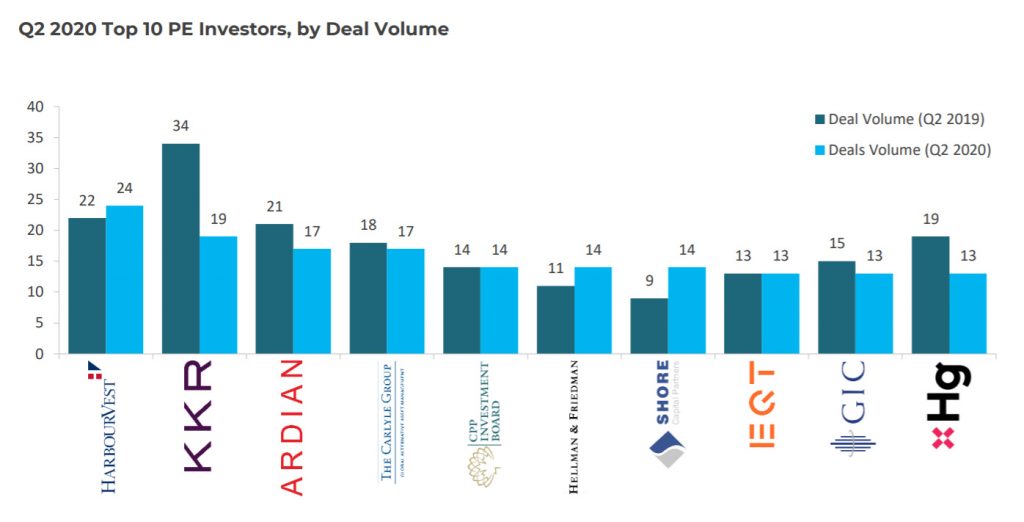

A look at the top investors’ deal activity reflects their cautious and selective investment approach in the new world. The top 25 PE investors in Q2 2020 were part of 298 deals, representing a drop of 34% as compared with the number of deals executed by the top 25 investors in Q2 2019. The investor list was dominated by US-based PE firms, with 56% of the top 25 PE firms by deal volume being headquartered in the country. Other countries contributing to the list of top 25 investors include Canada, UK, France, Sweden, Netherlands and Singapore.

Q2 2020 Top 10 PE Investors, by Deal Volume

High-value deals observe a significant drop in numbers

In Q2 2020, the number of $1bn+ deals dropped by ~40% to 28, as compared with the same quarter last year. The drop reflects investor’s hesitance to commit larger funds in these uncertain times. A more detailed look at the top 25 deals by value in Q2 2020 reflects investors readiness to spend higher money on Software (3 deals among top 25), and Communications and Networking (3 deals among top 25 deals) sectors – the sectors that are likely to gain from the pandemic.

Top Deals, by Value, Q2 2020

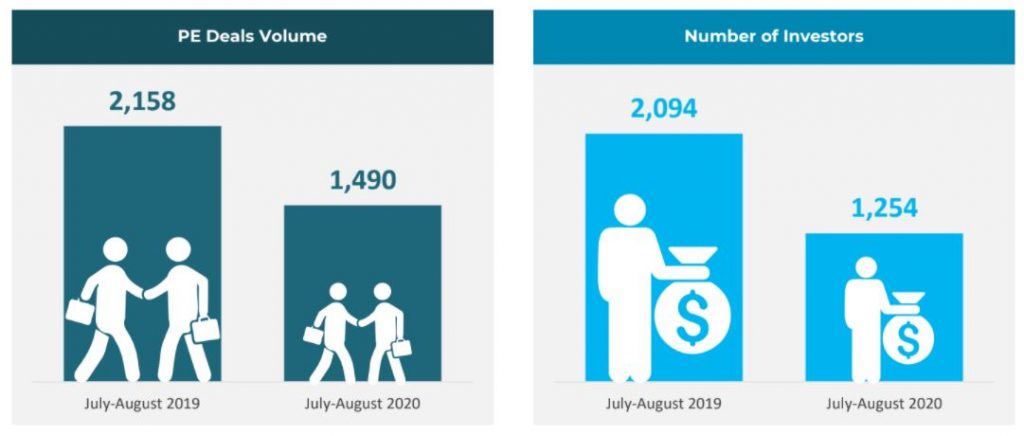

While deal activity remains subdued in Q3 so far, we foresee a gradual uptick going forward

While the first two months of Q3 2020 followed the trends witnessed in the last quarter, which was the slowest quarter in terms of PE deal activity over the last seven years, we anticipate a gradual improvement in volumes as economies and businesses move to recovery path once the pandemic’s impact recedes.

With over $1.5 trillion of dry-powder with PE funds globally, they are well positioned to make strategic investments in companies that are at forefront of innovation and are emerging as well-prepared and adapted to shift in consumer demand. We also foresee increasing add-on investments to fill capability, talent and technological gaps in existing PE portfolio companies, mainly emerging from changed business models. The future holds immense opportunities for PE firms that can find the right investments at an optimum valuation.